The global cryptocurrencies market size is valued at USD$1.95 billion in 2022 and is projected to reach USD$4.94 billion by 2030, growing at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2030. A cryptocurrency is a form of currency that only exists digitally and has no central issuing or regulating authority over it. It uses blockchain technology to authenticate transactions. Blockchain is a decentralized technology spread across many computers that manage and record transactions. Furthermore, it does not rely on banks to verify the transactions but is used as a peer-to-peer system that enables users to send and receive payments from anywhere in the world.

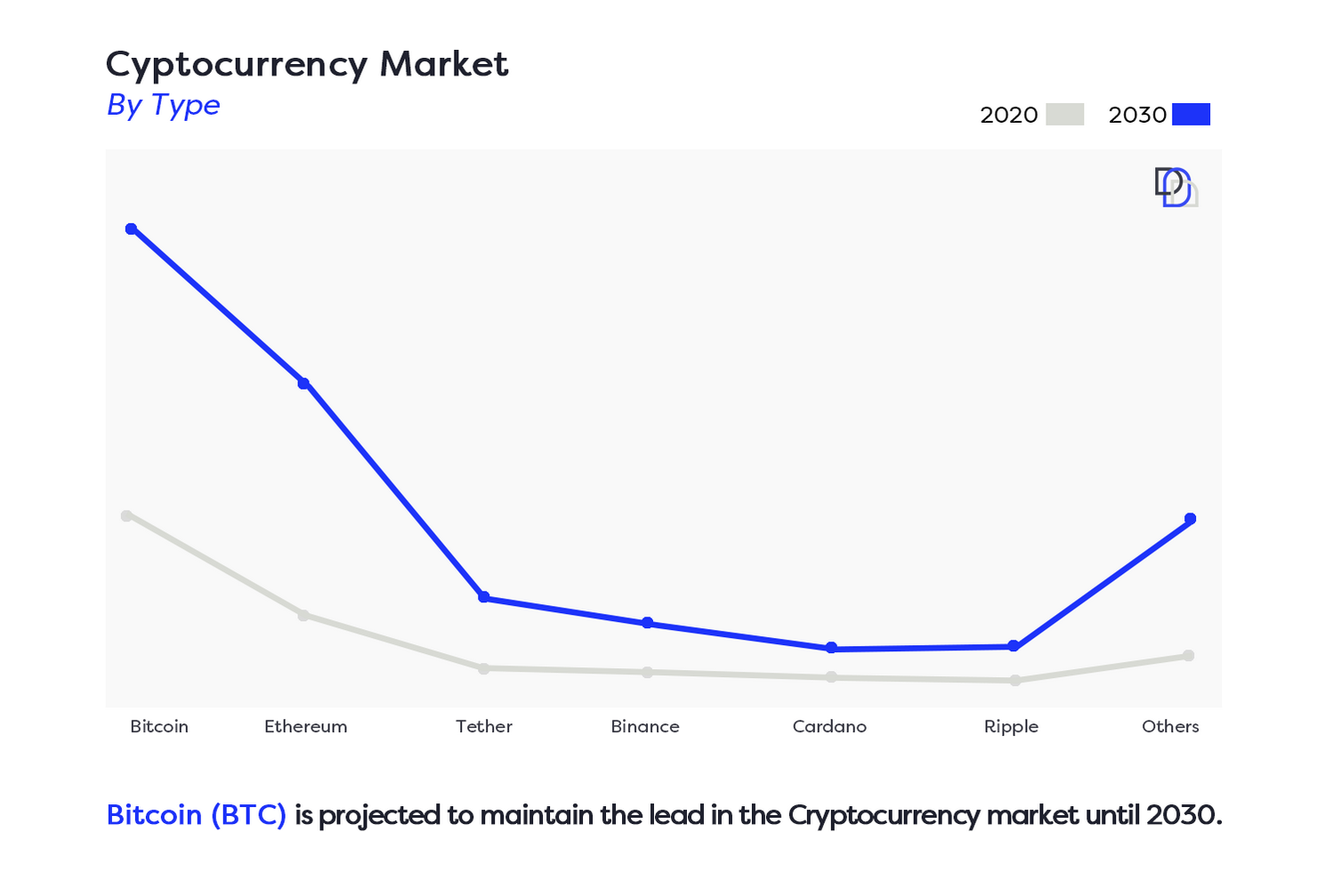

Bitcoin might be the headline cryptocurrency for many, but the market for digital currencies relying on blockchain technology is much bigger than that. Take, for instance, Ether: Initially released in 2015, the cryptocurrency is based on the open-source Ethereum blockchain – currently the more commonly used name for the coin – has become one of several virtual currencies with the most transactions on the ledger by 2021. This was reflected in Ethereum’s price, which nearly doubled between December 2020 and January 2022.

The primary factor driving the market’s growth is the increased use of distributed ledger technology and rising digital investments in venture capital. Developing countries have started using digital currency as a financial exchange medium.

The increasing popularity of digital assets like Bitcoin and Litecoin is likely to drive market growth in the forthcoming years. Moreover, digital currency is also often utilized with the integration of blockchain technology to attain decentralization and controlled efficient transactions. Blockchain technology offers decentralized, transparent, secure, fast and reliable transactions.

Key factors driving the global cryptocurrency market

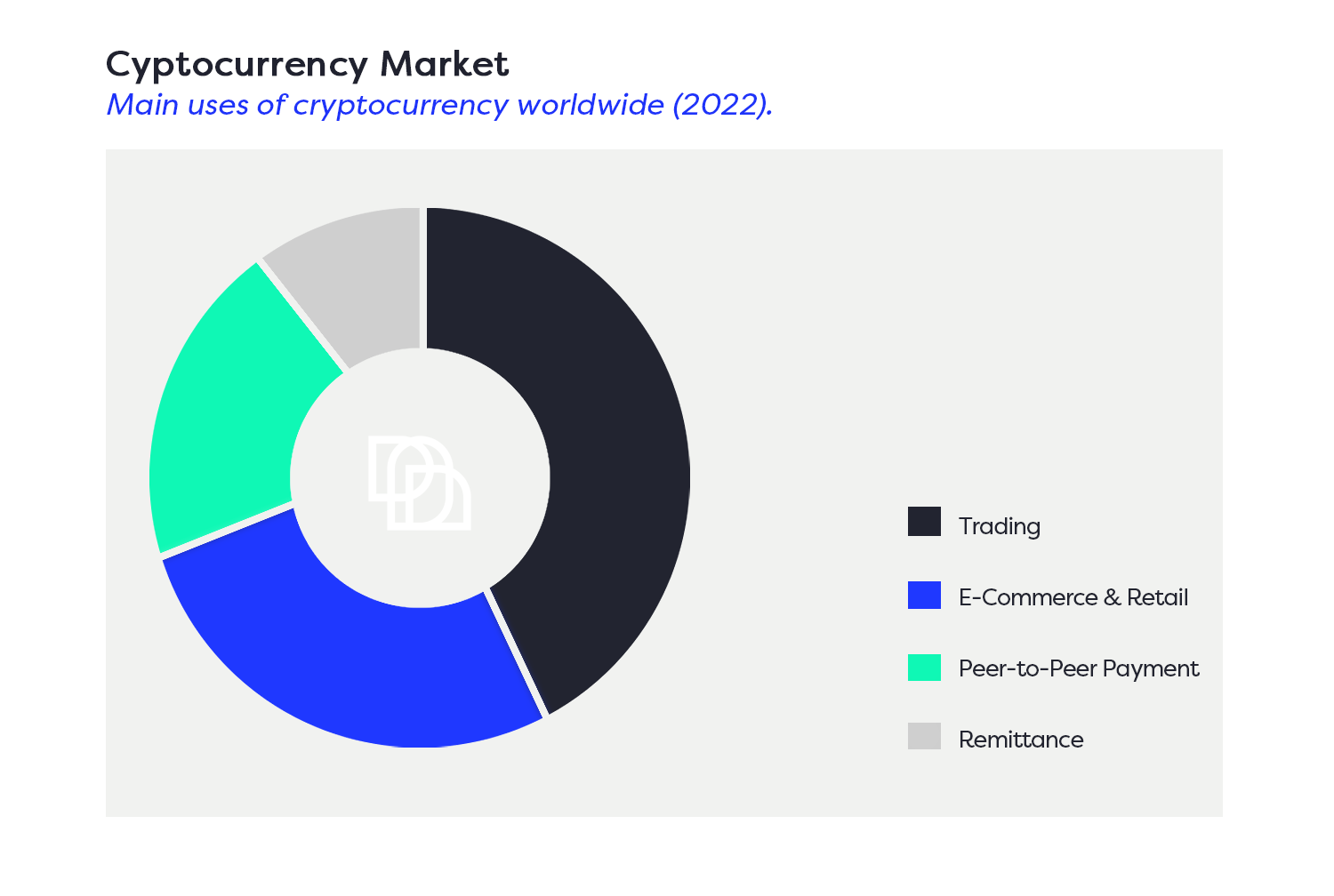

The extensive utilization of cryptocurrency for monitoring transactions through decentralized

networks to ensure safety, confidentiality, minimal transaction fees, etc., is currently driving the global cryptocurrency market.

Increasing digitization across industries represents one of the key factors driving the growth of the market. In line with this, easy accessibility to and rising penetration of high-speed internet connectivity in daily activities is also creating a positive outlook for the market.

Furthermore, legalization and approval of the purchase, sale or trade of virtual currencies in various developed countries are also driving the market growth. With the immense transparency of distributed ledger technology or blockchain, there is minimal risk of fraudulent or unwanted transactions due to human or machine error or data manipulation.

This enables all the parties to monitor any changes that are being made during the transaction in real-time, thereby offering enhanced data security and immutability of the transactions. Additionally, convenient access to online trading platforms that can be used through smartphones is contributing to growth in the market. Other factors, including growing market capitalization or market cap of the industry, along with the advent of bitcoin cash and bitcoin lite, are anticipated to drive the market further.

Key companies in the cryptocurrency market

Some of the major players in the global cryptocurrency market include Advanced Micro Devices Inc., Alphapoint Corporation, Bitfury Holding B.V., Coinbase Inc., Cryptomove Inc., Intel Corporation, Microsoft Corporation, Quantstamp Inc. and Ripple Labs Inc.

These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the cryptocurrency industry.

COVID-19 Impact on cryptocurrency use

The beginning of the COVID-19 pandemic had a negative impact on the cryptocurrency market. The level of stability in cryptocurrency significantly diminished while the irregularity level significantly augmented and cryptocurrencies became more volatile, causing a decline in the demand for cryptocurrency during a global health crisis.

Moreover, cryptocurrency exhibited a low level of regularity compared to international equity markets, which further declined the demand for cryptocurrency tremendously during the pandemic.

But as the situation progressed and stabilized worldwide the pandemic actually led to the increase in adoption of digital alternatives to money, such as cryptocurrency, as it enabled secured online payments, resulting in limited use of manual payment methods to combat the risk of the coronavirus infection.

There is an overwhelming amount of evidence to support the likelihood that the cryptocurrency market will continue to grow strongly and steadily. Let’s review some of the most relevant figures

According to cryptocurrency user statistics, new users are being added to the cryptocurrency network each day. Also, the number of cryptocurrency transactions that take place daily is on the rise. Let’s have a look at the top cryptocurrency users’ statistics for 2022:

There were 81 million digital wallet users in February 2022.

Users store their personal data in wallets. It works like a regular wallet or bank account, just in digital form. By Q4 of 2020, there were 63M wallet owners, but that number increased steadily until Q1 2022.

Europe will see blockchain funding of USD$300 billion by 2022.

After consulting with over 200 B2B blockchain companies, David Chreng-Messembourg is confident that funding will increase in the coming years. According to blockchain statistics, their financing will reach 350 million Euros or USD$425 million by 2022 to 2023.

The region has been developing rapidly when it comes to blockchain, and in the next few years, the adoption will continue.

By the end of 2030, banks will save USD$27 billion through blockchain adoption.

Banks often lose a lot due to procedures like money-laundry checks, payment processing, reconciliations, compliance, and treasury operations. The implementation of blockchain will see financial institutions save over USD$25 billion by 2030. That will cut the organization’s expenses in half.

Daily transactions for Bitcoin nearly reached the 400,000 mark in the first quarter of 2022.

Bitcoin user growth has propelled it to have more transactions than ever before. As of January 2021, its entries were more than those of January 2018, with a difference of 78,722 transactions per day.

Bear in mind that Q1 of 2021 was a time when most economies were emerging from the ashes of the COVID-19 pandemic.

Therefore, its performance was exemplary considering the circumstances. People are now showing interest in Bitcoin more than ever. It’s gaining more traction compared to other cryptocurrencies.

Coinbase has 89 million users as of Q1 of 2022.

As you may know, Coinbase is one of the most dominant crypto exchanges on the globe. It filed to go public in 2021 having made good gains in revenue the previous year.

Sources:

Allied Market Research (www.alliedmarketresearch.com)

Statista (www.statista.com)

Fortune Business Market Research Report, published on Oct. 2021

Fortune Business Insights (www.fortunebusinessinsights.com)

Coinbase (www.coinbase.com)

Time Magazine (time.com)

Trading View (www.tradingview.com)